Plan Your Financial Future with Expert Guidance

In today's complex financial landscape, our expert advisors are here to help you navigate the uncertainties and design a customized plan that aligns with your unique financial goals and aspirations.

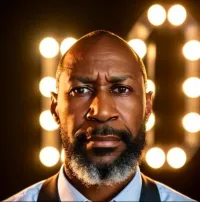

The Woke Investor

The Woke Investor: Empowering African American Voices Through Activist Investing

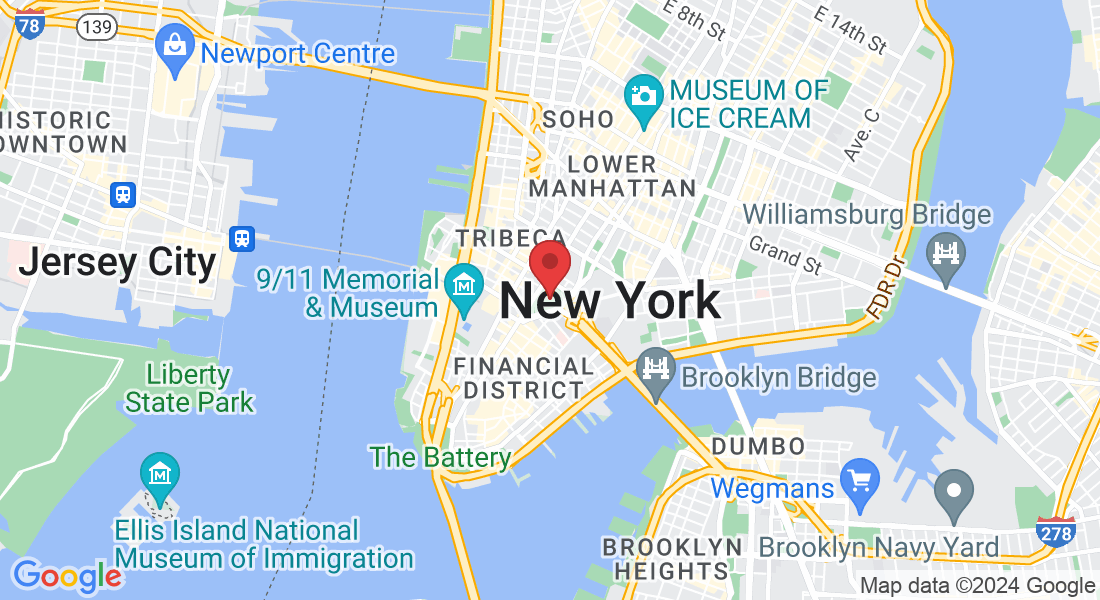

In the heart of New York City, Wall Street stands as a towering symbol of financial power and influence. Yet, beneath its gleaming façades lies a history intertwined with the early American slave trade, a somber reminder of a past where African Americans were not only denied the fruits of their labor but also the very rights to ownership and economic participation. Today, the legacy of African American resilience and the ongoing struggle for equity and justice are mirrored in the burgeoning field of activist investing, presenting a unique opportunity to exercise power within the very financial systems that once perpetuated inequality.

From Wall Street's Shadows to the Forefront of Financial Activism

The historical significance of Wall Street to the African American community cannot be understated. In the 17th and 18th centuries, the area that would become the financial epicenter of the world was also a site where enslaved Africans were bought and sold, their lives commodified alongside the goods they were forced to produce. This painful history is a stark contrast to the potential Wall Street holds today for African American investors to wield economic power and influence.

Activist investing, the practice of using one's investment portfolio to support social, environmental, and governance causes, offers a path to rectify historical injustices through the power of capital. For African Americans, this means not only the opportunity to build wealth but also to influence the practices of corporations to reflect values of diversity, equity, and sustainability.

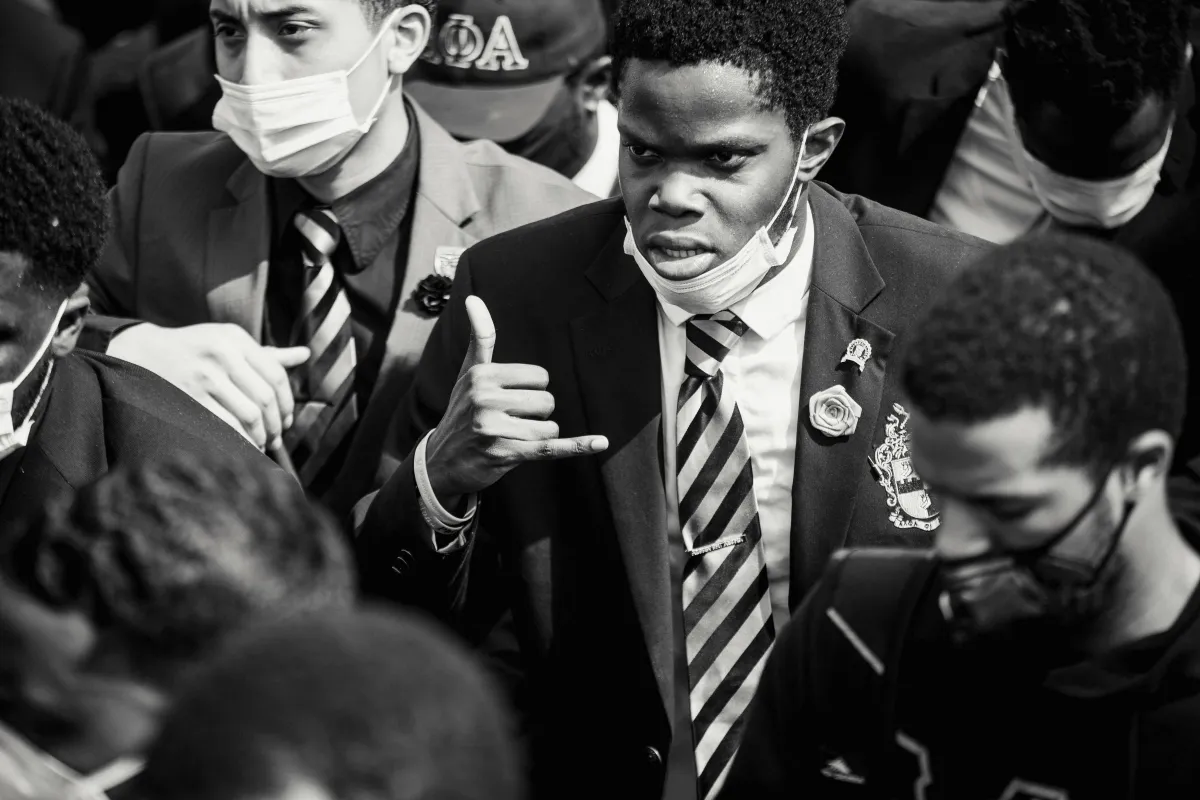

The Role of the African American Investor

African American investors have a critical role to play in shaping the future of corporate America. By prioritizing investments in companies that champion racial equity, environmental stewardship, and ethical governance, they can drive positive change from within the system. This approach combines the pursuit of financial returns with the quest for social justice, embodying the spirit of "woke" investing.

Moreover, African American investors can leverage their collective power to advocate for change through shareholder activism. By voting on shareholder resolutions, engaging in dialogue with company management, and participating in activist campaigns, they can influence corporate policies and practices, ensuring they align with the values of diversity, inclusion, and social responsibility.

The Significance of History in Today's Financial Environment

The historical context of Wall Street's relationship with the African American community underscores the significance of their participation in today's financial environment. By engaging in activist investing, African Americans can reclaim a space that was once a source of oppression and turn it into a platform for empowerment and change. This not only honors the legacy of those who fought for freedom and equality but also paves the way for future generations to thrive.

Activist investing also serves as a powerful reminder that economic liberation is intrinsically linked to social justice. As African American investors increasingly influence the financial landscape, they contribute to a broader movement towards a more equitable and just society.

Conclusion

The journey from the shadows of Wall Street's past to the forefront of financial activism is a testament to the resilience and determination of the African American community. Through activist investing, African Americans have the opportunity to exercise power in today's financial environment, transforming their economic destinies while advocating for systemic change. As we continue to navigate the complexities of modern capitalism, the principles of woke investing offer a beacon of hope, guiding us towards a future where financial success and social justice go hand in hand.

What we do

Ethical and Fiduciary Responsibility

As fiduciaries, we hold ourselves to the highest ethical standards. Your financial interests always come first, and we are dedicated to providing you with unbiased advice that is solely in your best interest. You can trust us to act with integrity and professionalism.

Good Approach

Great Ideas

Save Money

Detailed Report

Around-the-Clock Financial Guidance

At [Your Company Name], we understand that financial questions and concerns don't adhere to a 9-to-5 schedule. That's why our 24/7 financial advisory services are always available to you. Whether you have a pressing financial issue in the middle of the night or need guidance during the weekend, our team of expert advisors is here to assist you at any time.

Comprehensive Financial Planning

Highlight your comprehensive financial planning services, which involve a holistic assessment of a client's financial situation. Describe how you work closely with clients to set financial goals, create personalized financial plans, and provide ongoing guidance to help them achieve their objectives. Mention areas you cover, such as retirement planning, investment management, tax planning, and estate planning.

Investment Management

Promote your investment management services, where you assist clients in building and managing investment portfolios aligned with their financial goals and risk tolerance. Explain your approach to asset allocation, portfolio diversification, and investment strategies tailored to individual needs.

Retirement Planning

Emphasize your retirement planning services. Describe how you help clients plan for a secure and comfortable retirement by assessing their retirement goals, estimating retirement income needs, and creating strategies for retirement savings and withdrawals. Highlight your expertise in optimizing retirement accounts, such as 401(k)s and IRAs.

Estate Planning and Wealth Transfer

Showcase your estate planning and wealth transfer services. Explain how you assist clients in preserving and transferring their wealth efficiently to heirs and beneficiaries while minimizing estate taxes. Describe strategies for creating wills, trusts, and legacy plans tailored to their unique circumstances.

Our Team

JOHN DOE

JOHN DOE

JOHN DOE

FAQS

What is the benefit of working with a financial advisor?

Working with a financial advisor offers numerous benefits. First and foremost, advisors provide expertise and guidance tailored to your unique financial situation and goals. They can help you create a comprehensive financial plan, optimize your investments, minimize taxes, and ensure you're on track to achieve your financial objectives. Additionally, advisors offer peace of mind, knowing that you have a professional managing your financial affairs and helping you make informed decisions.

How do I choose the right financial advisor for my needs?

Choosing the right financial advisor is a critical decision. Start by assessing your own financial goals and preferences. Look for advisors with the appropriate qualifications and certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Consider their experience, specialization, and track record. It's also important to have a consultation or interview to ensure their approach aligns with your values and objectives. Lastly, check for transparency in fees and compensation to avoid surprises.

Do I need a large portfolio to benefit from financial advisor services?

No, you don't need a large portfolio to benefit from financial advisor services. Financial advisors can assist individuals at various stages of their financial journey, from those just starting to save to those with substantial assets. Advisors can help you create a financial plan, manage debt, set up an emergency fund, and make the most of your resources, regardless of your current wealth. Their goal is to help you improve your financial well-being and work towards your financial goals, whatever they may be.

What Are Our Customers Saying ?

Feedback from our delighted clientele.

I can't thank [Your Company Name] enough for their unwavering support and expert guidance. When my husband and I faced a sudden financial crisis, we didn't know where to turn. They were there for us, day and night, helping us make sound decisions.

JANE DOE

I've been a client of [Your Company Name] for years, and I can confidently say they've transformed my financial outlook. Their 24/7 services have allowed me to seize investment opportunities at the right moment and navigate market turbulence with ease.

JANE DOE